Thailand taxes its tax residents based on residency basis and at least in theory a Thai tax resident pays Thai personal income tax on worldwide income. But Revenue Department’s existing narrow interpretation of Section 41, paragraph 2 of the Revenue Code results in many Thai tax resident (Thais or foreign individuals) not being liable for paying personal income tax on the overseas income.

1. Revenue Department’s Existing Interpretation

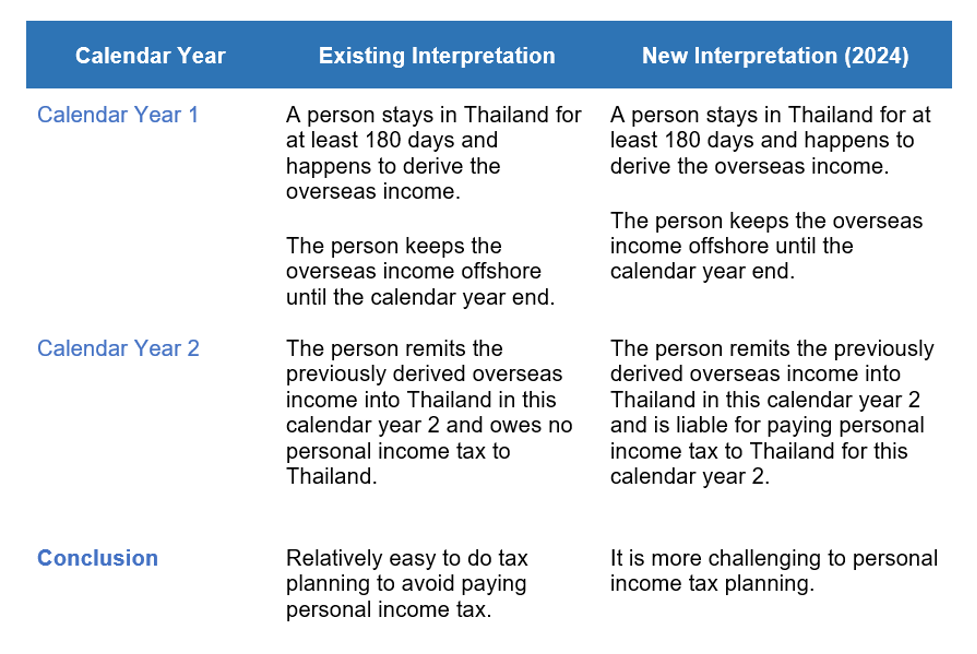

Historically (up to 2023) in practice Thailand rarely taxes its tax residents on the worldwide income at all, but only taxes the territory income (Thailand income) because the Revenue Department narrowly construed Section 41, paragraph 2 of the Revenue Code that a Thai tax resident must pay Thai personal income tax on the overseas income if these two conditions are duly fulfilled.

1. A Thai tax resident derives any overseas income in any calendar year in question.

2. The Thai tax resident derives such overseas income into Thailand in the same calendar in which the overseas income is derived. (A same year remittance rule.)

With this existing interpretation, any Thai tax resident (including any foreigner who stays in Thailand for at least 180 days or longer in any calendar year) can easily avoid paying Thai personal income tax by remitting the overseas income into Thailand in any subsequent calendar year. One may earn any overseas income in 2019 and keep the fund (the overseas income) in a bank account in a foreign country until at least January 1, 2020 before remitting the fund into a bank account in Thailand, and the Thai tax resident is not liable to pay Thai personal income tax whatsoever.

Section 41 of the Revenue Code

"A taxpayer who in the previous tax year derived assessable income under Section 40 from an employment, or from business carried on in Thailand, or from business of an employer residing in Thailand, or from a property situated in Thailand shall pay tax in accordance with the provisions of this Part, whether such income is paid within or outside Thailand.

A resident of Thailand who in the previous tax year derived assessable income under Section 40 from an employment or from business carried on abroad or from a property situated abroad shall, upon bringing such assessable income into Thailand, pay tax in accordance with the provisions of this Part.

Any person staying in Thailand for a period or periods aggregating 180 days or more in any tax year shall be deemed a resident of Thailand.”

Any individual who stays in Thailand for at least 180 days in a calendar year is deemed a Thai tax resident for that calendar year by the Revenue Code regardless of individual’s citizenship or nationality without any consideration to individual’s immigration status.

2. Revenue Department’s New/2024 Interpretation (Keeping the Overseas Income Offshore Until the Next Calendar Year No Longer Saves Personal Income Tax)

Eventually, the Revenue Department does not like the existing interpretation because the existing interpretation makes it difficult, if not impossible, for the department to tax any overseas income of any Thai tax resident at all. On September 15, 2023, the Director General of the Revenue Department issues the Departmental Instruction No. Por. 161/2566 Re Payment of Income Tax under Section 41, Paragraph 2 of the Revenue Code (the “Instruction No. Por. 161/2566”) to re-interpret Section 41, paragraph 2 that any Thai tax resident who derives overseas income in a particular calendar year and bring such overseas income into Thailand in any calendar year must bring such assessable income to compute the annual assessable income in the calendar year that such person remits the overseas income into Thailand. In other words, the Thai tax resident must pay Thai personal income tax on such overseas income even if he/she brings such overseas income into Thailand in a different calendar year than the calendar year in which the overseas income is derived. Instruction No. Por. 161/2566 shall come into force from January 1, 2024.

3. Possible Solutions

As explained above, under Section 41, last paragraph of the Revenue Code, anyone who happens to stay in Thailand for at least 180 days (or a longer period) in any calendar year will be subject to Thai personal income tax. A Thai tax resident could be either a Thai citizen or a foreign individual. With a big loophole being closed, here are certain options that any Thai tax resident can pursue to avoid or delay paying personal income tax on overseas income.

Option 1. Keeping Overseas Income Outside Thailand Perpetually

One may earn any overseas income in 2024 and keep the fund aboard forever, and the Thai taxpayer will not have to pay any Thai income tax on such overseas. This is not a difficult option for a foreign individual to do. But even a Thai earner of overseas income will have to learn to do the same.

Option 2. Use of Tax Treaty

Typically, the overseas income may be subject to source country’s foreign income tax. If the source country has a tax treaty with Thailand, one may procure necessary documentation from the tax authority in the source country to claim a foreign tax credit in paying personal income tax to Thailand.

Option 3. Use of Long Term Resident Visa

A foreigner may apply and procure a Long Term Resident (LTR) visa in categories of (i.) Wealthy Global Citizen, (ii.) Wealthy Pensioner and (iii.) Work From Thailand Professional / Nomad. A holder of LTR visa in any of these three categories will be exempt from Thai personal income tax by the Royal Decree No. 743 issued by virtue of the Revenue Code even if such LTR visa holder brings such overseas income into Thailand. However, the LRR visa holder must comply with the conditions laid down by the Office of Board of Investment (“BOI”).

____________________________________________________________________________________

This legal article was written by Narit Direkwattanachai, a corporate, tax & trial attorney at NARIT & Associates with expertise in corporate & commercial, commercial dispute and tax law. He holds a bachelor of laws (1st class honors) from Chulalongkorn University, a master of law from the University of Cambridge, UK and an MBA in finance from the Georgia Institute of Technology, USA. He can be reached at narit@naritlaw.com

Visit: www.naritlaw.com